Introduction: Unlocking Stagnated Growth in Life Insurance

The life insurance industry stands at a critical juncture. Despite a clear and growing consumer need, the sector has faced stagnating growth for over a decade. A joint report by Bain & Company and LIMRA highlights a significant “protection gap” and outlines strategic avenues to revitalize industry expansion. This analysis delves into the core challenges and presents actionable strategies for carriers to unlock substantial market potential and better serve millions of uninsured or underinsured consumers.

The Decades-Long Stagnation and Growing Need

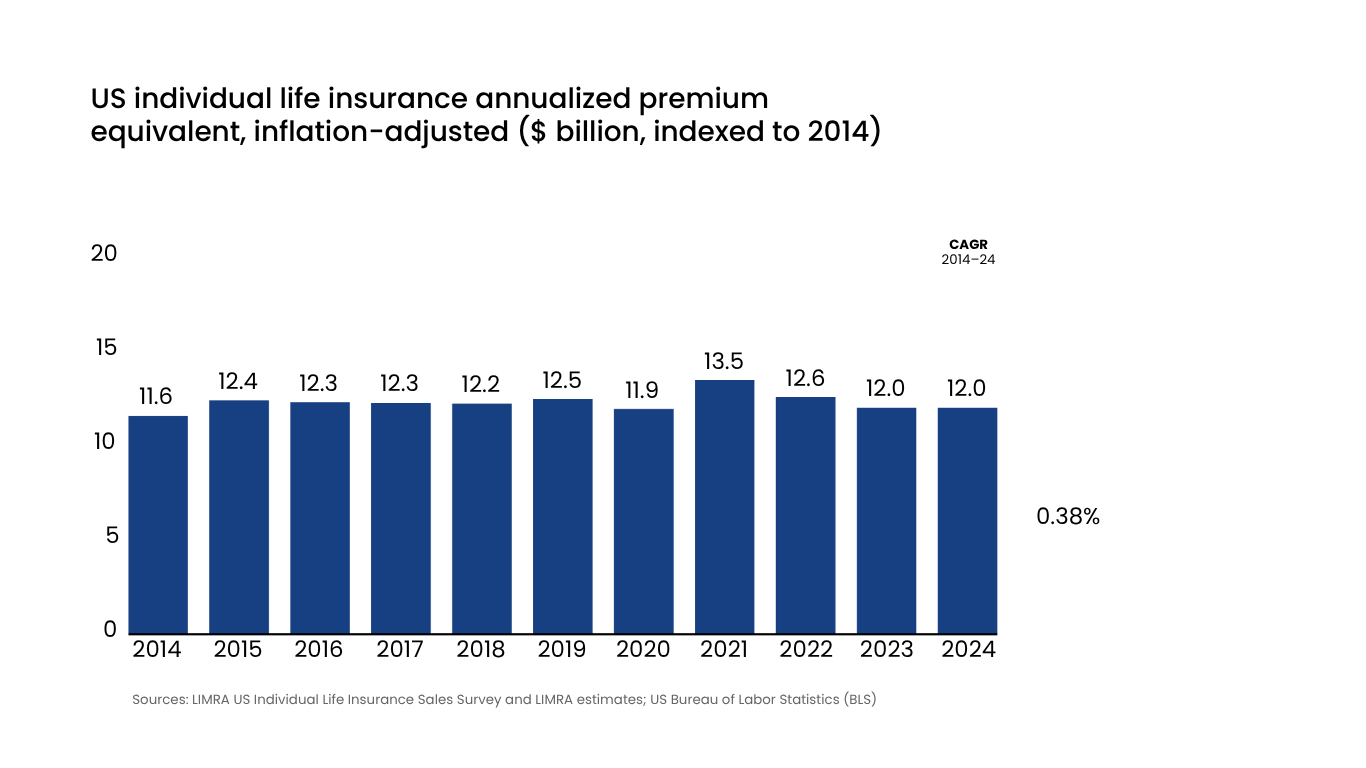

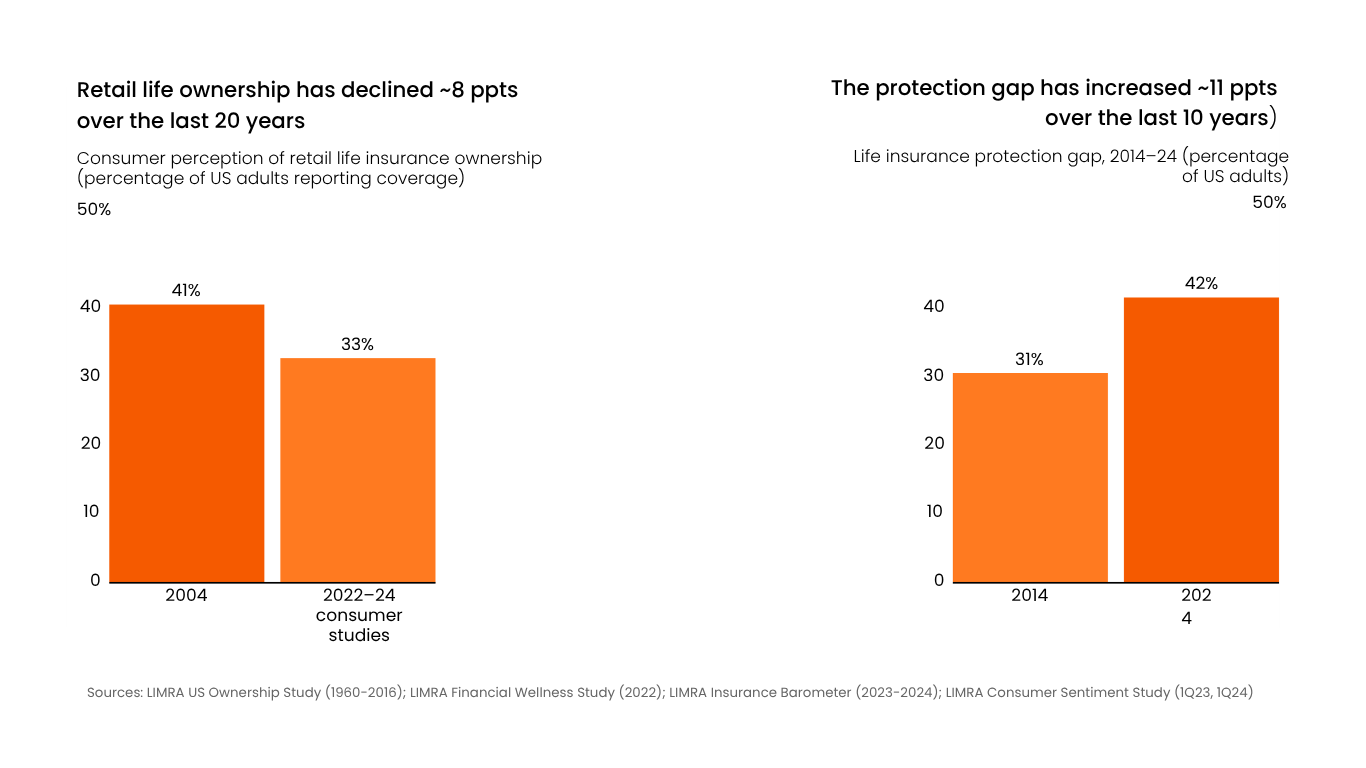

Individual life insurance has seen essentially zero real growth over the past decade. While a brief surge in sales occurred during the COVID-19 pandemic, this was temporary, with sales quickly flatlining again. This contrasts sharply with the expansion observed in other financial services sectors.

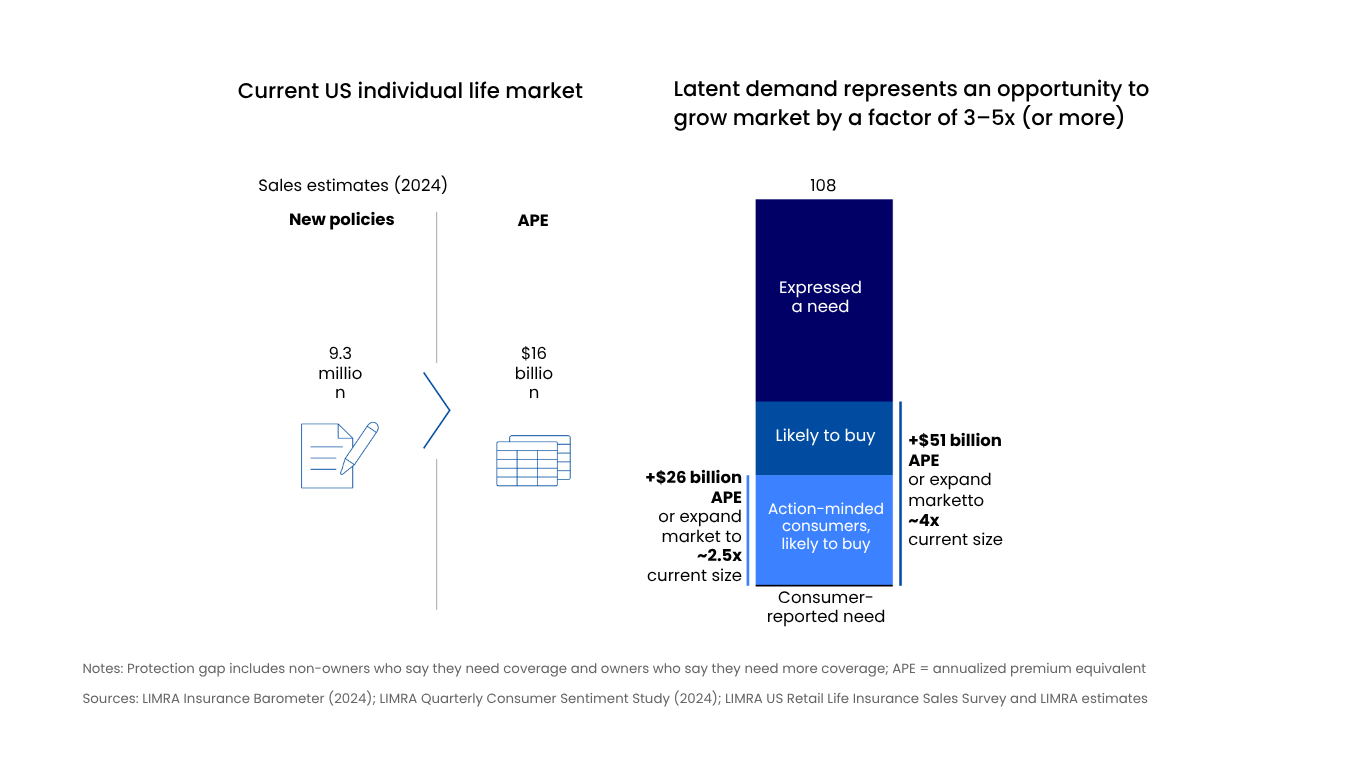

Simultaneously, the “protection gap” continues to widen. In 2024, 42% of US adults reported not having enough, or any, life insurance coverage, despite acknowledging a need for it. This latent demand represents an enormous opportunity: addressing it could potentially increase the current market size by three to five times. Many within this gap have sufficient household income (over 80% have at least $50,000, and one-third have $150,000 or more), indicating that affordability, while a concern, is often a perceived barrier rather than the sole issue.

Understanding Consumer Behavior: Barriers to Purchase

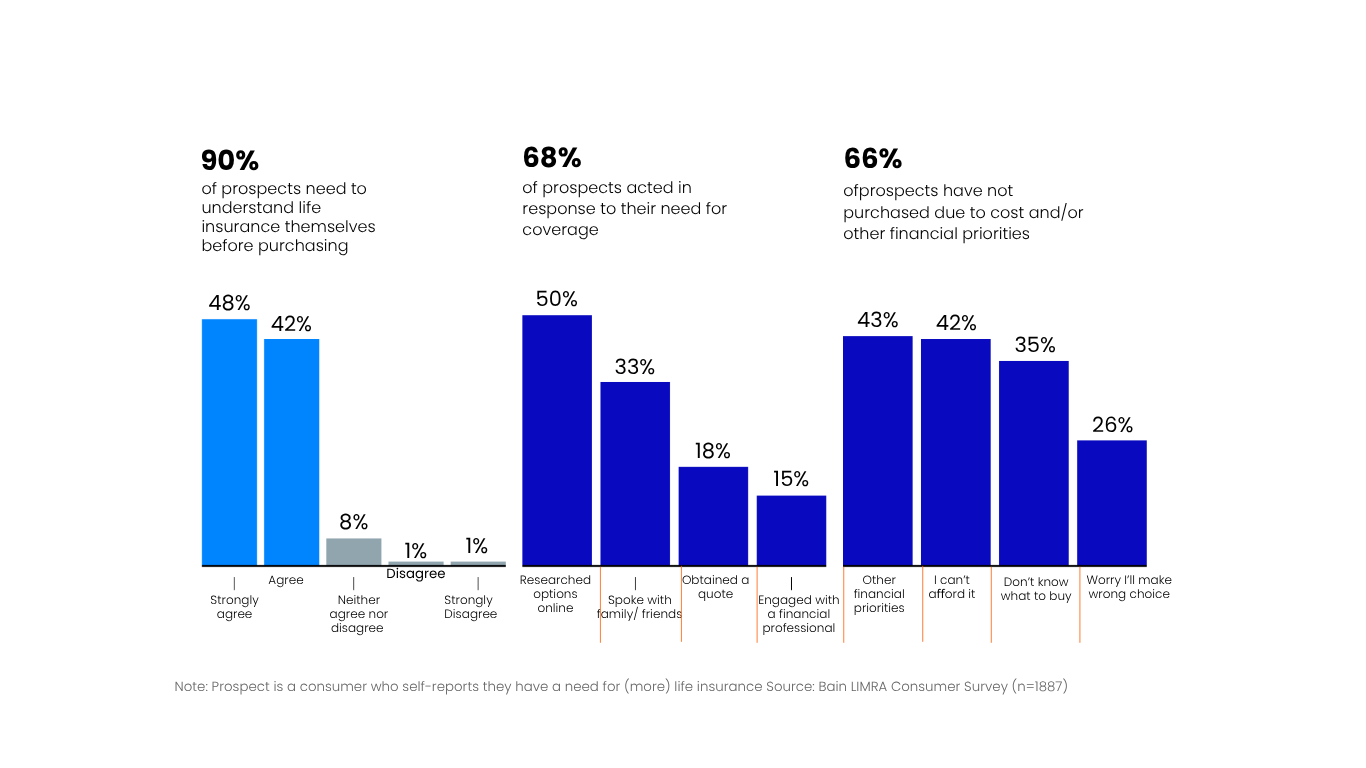

So, what prevents interested consumers from purchasing? The report points to a fundamental failure by insurance carriers to convert consumer interest into action. Three key barriers emerge during the life insurance discovery process:

• Lack of Accessible, Straightforward Information:

A staggering 90% of consumers want to understand life insurance for themselves before purchasing. They often turn to carrier websites as primary sources, yet these sites can be complex, filled with jargon, and poorly designed for consumer self-education.

• Misconceptions Around Affordability:

Nearly three-quarters of Americans overestimate the true cost of a basic term life policy. This significant overestimation, particularly by younger demographics (half of Gen Z and millennials overestimating by more than three times), creates a formidable barrier.

• Difficulty Finding and Engaging a Trusted Financial Professional:

While 72% of prospects express a desire to speak with a financial professional, only 15% actually do so. This “engagement gap” is critical, as financial professionals report high conversion rates when matched with interested clients.

Strategic Actions: Aligning Marketing and Distribution for Growth

To bridge this formidable coverage gap, carriers must align their marketing and distribution efforts to meet consumers where they are and provide the information and access they need. The report outlines four key actions for improved coordination:

1. Optimize Outbound Marketing to Target Key Life Events:

Two in five consumers recognize their need for life insurance after significant life events like marriage, having a child, or a death in the family. Carriers can leverage performance marketing via digital channels (e.g., targeted social media, display ads) to reach these consumers with precise, cost-effective messaging tailored to their specific moments of need.

2. Help Consumers Self-Educate with Clearer Information and Transparent Pricing:

Since 90% of consumers desire self-education, carriers must simplify the learning journey. This includes making product details clearer, more accessible, and easier to navigate. Communication around costs should be transparent and relatable, such as comparing premiums to everyday expenses (e.g., “it’s cheaper than five cups of coffee”).

3. Make it Easy to Find a Financial Professional and Provide Qualified Leads:

Four in ten prospects search for an advisor but never engage. Carriers should implement “Find an advisor near me” tools and offer diverse engagement options (e.g., text, phone, self-scheduling) to simplify the connection process. Furthermore, carriers need to support their financial professionals with better lead generation and follow-up processes.

4. Experiment with Alternate Channels for Low-Cost Test and Learn:

traditional channels will remain dominant, leveraging online direct-to-consumer (D2C) channels offers a low-cost, low-risk opportunity for carriers to experiment. Engaging directly with the smaller segment of consumers who purchase online can yield valuable insights to enhance strategies across all channels.

Conclusion: A New Era of Growth for Life Insurance

The challenge for the life insurance industry is clear, but so is the immense opportunity. By addressing core consumer barriers related to information accessibility, financial professional accessibility, and perceived affordability, carriers can protect more than 100 million uninsured or underinsured consumers. This requires a coordinated effort between marketing and distribution, meeting consumers where they are with clear, simple information and easy pathways to engagement.

Elev8ive.co is committed to helping financial services organizations navigate these complex challenges and unlock new avenues for growth.

Are you ready to redefine your life insurance strategy and tap into this significant market potential?